Your Guide to non resident property tax spain: Compliance Made Easy

Owning a home in Spain is an absolute dream, but let's be honest—the subject of non-resident property tax in Spain can feel like navigating a maze. The most important thing to grasp from the start is this: as a non-resident owner, you're responsible for several different taxes, not just a single annual bill. They pop up at different times, from yearly payments to taxes due only when you sell. Getting your head around these obligations is the first real step to enjoying your property with complete peace of mind.

Decoding Your Spanish Property Tax Obligations

Think of your journey as a Spanish property owner like a road trip with a few mandatory stops. Instead of one big, overwhelming property tax, the Spanish system breaks it down into smaller, more manageable payments. Each tax has a different purpose and is paid to a different authority at a different time of year.

This guide is your financial GPS for that journey. We're going to break down every key tax you'll come across, turning what seems like confusing red tape into simple, actionable knowledge. We’ll focus on giving you real clarity, especially if you own property on the beautiful Costa Blanca and Costa Cálida, where firms like AP Properties Spain are experts in helping international buyers.

The Four Main Taxes for Non-Resident Owners

To build a solid understanding, it's easiest to group the taxes into four main categories. Picture these as the four pillars holding up your tax compliance structure in Spain. Get to know each one, and you’ll ensure your foundation is secure, with no unwelcome surprises from the Spanish tax authorities down the line.

Here are the essential taxes we’ll explore in detail:

- IBI (Impuesto sobre Bienes Inmuebles): This is your annual local council tax. It's paid directly to your local town hall (Ayuntamiento) and goes towards funding community services like street cleaning, parks, and local infrastructure.

- IRNR (Impuesto sobre la Renta de No Residentes): This is the non-resident income tax. The crucial part here is the tax on "imputed income," which applies to personal-use properties even if you never rent them out. It's a tax on the potential benefit of owning the property.

- Capital Gains Tax: This is a national tax that comes into play only if you decide to sell your Spanish property. It’s calculated on the profit you make from the sale.

- Wealth Tax (Impuesto de Patrimonio): Don't let the name worry you. This tax only affects individuals with very high-value assets in Spain. Thanks to a generous tax-free allowance, the vast majority of non-resident owners are completely exempt.

By understanding these four core taxes, you're taking control of your financial responsibilities. This proactive approach prevents headaches later on and lets you focus on what really matters—enjoying the incredible lifestyle your Spanish property offers.

Throughout this guide, we'll use practical examples and straightforward language. Our goal is to completely demystify the rules and give you a clear path for managing your non-resident property tax in Spain. Let’s dive in, starting with the one tax every single owner has to pay: the IBI.

IBI: The Annual Property Tax You Need to Know

Every single person who owns property in Spain, whether they live here full-time or just visit for a few weeks a year, has to pay the Impuesto sobre Bienes Inmuebles, better known as IBI.

Think of it as the Spanish equivalent of council tax. It's a yearly payment you make to your local town hall (Ayuntamiento) which goes towards funding essential public services—everything from keeping the streets clean and maintaining local parks to funding the police and other vital infrastructure.

The IBI is a cornerstone of the non resident property tax in Spain, and thankfully, it’s quite straightforward to understand. The amount you pay is based on two key figures:

- The Valor Catastral: This is the official administrative value of your property, recorded in the land registry (Catastro). Crucially, this is not the same as the market value.

- The Municipal Tax Rate: This is a percentage set by your local town hall, which they then apply to the valor catastral.

One of the most important things to grasp is that the valor catastral is almost always much lower than what you actually paid for your property. It’s typically 60-70% below the market value, which is great news because it keeps the annual IBI payment very manageable for most owners.

How Your Location Determines Your IBI Bill

This is where things get interesting. The tax rate applied to your property isn't a single, national standard; it's decided at the local municipal level. This means your annual IBI bill can vary dramatically depending on which town your property is in—even if it's just a few kilometres down the road from another.

Let's take a real-world example. Imagine you own a stunning sea-view villa in Torrevieja. For 2025, this popular Costa Blanca hotspot has one of the lowest IBI rates in the entire region at just 0.400%. If your property has a valor catastral of €150,000, your annual IBI would be a mere €600.

Now, let's look at a similar property in Dénia, a beautiful town further up the coast. The rate there is a much higher 1.050%. For the exact same valor catastral of €150,000, the IBI bill jumps to €1,575—that’s more than double! You can find more insights on how different Costa Blanca IBI rates compare on inmoinvestments.com.

To illustrate this point further, here’s a quick comparison of popular areas in the Costa Blanca.

IBI Tax Rate Comparison Across Costa Blanca Municipalities

| Municipality | IBI Rate (%) | Example Annual Tax on €150,000 Valor Catastral |

|---|---|---|

| Torrevieja | 0.400% | €600 |

| Rojales | 0.450% | €675 |

| Orihuela | 0.569% | €854 |

| Benidorm | 0.668% | €1,002 |

| Pilar de la Horadada | 0.670% | €1,005 |

| Jávea (Xàbia) | 0.840% | €1,260 |

| Dénia | 1.050% | €1,575 |

As you can see, the difference between owning a property in Torrevieja versus Dénia could mean saving nearly €1,000 every single year on this one tax alone.

This variation really highlights why it’s so important to research local tax rates before you buy. While IBI might not be your biggest expense, a lower rate can lead to significant savings over the lifetime of your property ownership.

Understanding Your IBI Payment Process

Paying your IBI is a relatively simple affair. Your town hall, or a regional body they delegate to (like SUMA in the Alicante province), will issue a bill each year. For most non-residents, the easiest and safest way to handle this is by setting up a direct debit from a Spanish bank account. It ensures the payment is never missed.

A few key details to keep in mind:

- Payment Window: There's a specific period each year for payment. It’s usually in the autumn, but this can vary by municipality.

- Late Penalties: If you miss the deadline, you’ll face penalties. This is why automating the payment with a direct debit is so highly recommended.

- Shared Responsibility: If you co-own a property, all owners will be listed on the bill, but the Ayuntamiento only requires a single payment for the full amount.

At the end of the day, the IBI is a predictable and fundamental part of owning a home in Spain. By understanding how it's calculated and the impact of local rates, you can budget accurately for this recurring cost and avoid any unwelcome surprises. That leaves you free to simply enjoy your Spanish home.

The Imputed Income Tax for Unrented Properties

This is often the biggest surprise for non-resident property owners in Spain. It seems logical, doesn't it? If you don't rent out your property, you shouldn't have to pay any income tax on it. But the Spanish tax authority, the Hacienda, sees things a little differently. They consider the simple fact that you have a property available for your personal enjoyment as a taxable benefit—even if it sits empty most of the year.

This concept is officially called imputed income tax, sometimes referred to as 'deemed rental income'. In short, the law presumes you're getting a "benefit-in-kind" from owning a second home. To put a value on this benefit, the system creates a theoretical or 'imputed' income based on the property's official value. This imaginary income is then taxed.

While it might sound a bit abstract, the calculation is actually quite straightforward. It’s a key part of the Non-Resident Income Tax, known as Impuesto sobre la Renta de No Residentes or IRNR, and it's something you must file annually using Form 210.

How to Calculate Your Imputed Income Tax

Let's walk through this step-by-step. The whole process starts with the valor catastral—the same official tax value we covered for the IBI tax.

- Find Your Imputed Income Base: First, you calculate your theoretical annual income. This is simply a small percentage of your property's valor catastral. The percentage you use depends on how recently this value was updated by your local council.

- 1.1% is the rate if the valor catastral has been revised in the last 10 years (which is true for most properties these days).

- 2.0% is used if the valor catastral is an older valuation that hasn't been updated in the past decade.

- Apply the Right Tax Rate: Once you have that imputed income figure, you apply the non-resident tax rate. This rate is determined by where you are a tax resident.

- 19% for residents of the European Union (EU), Iceland, Norway, and Liechtenstein (EEA).

- 24% for all other non-residents, including those from the UK, USA, and Canada.

Key Takeaway: You're not being taxed on your property's entire value. You're taxed on a tiny fraction of it, which makes this an affordable but absolutely mandatory annual tax. It must be filed and paid by the 31st of December of the year following the tax year.

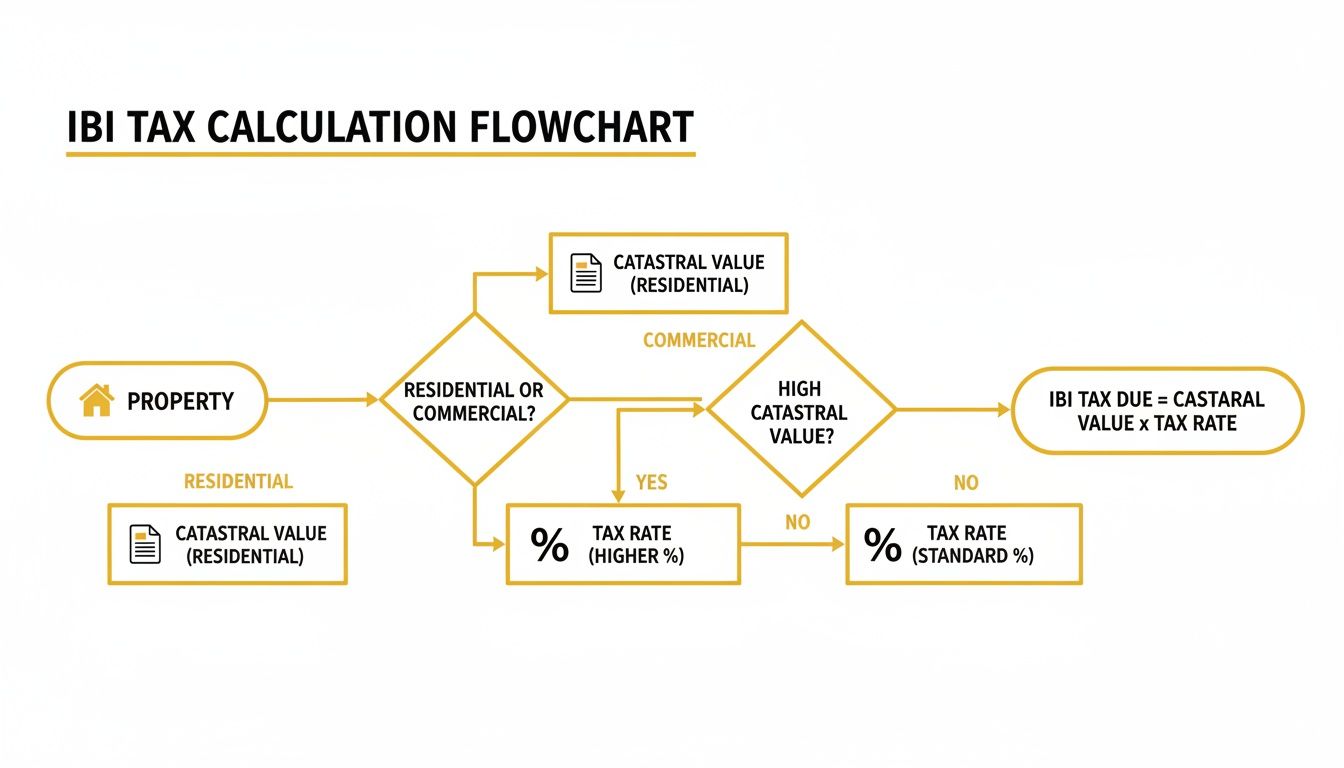

This flowchart gives you a clear visual breakdown of how the key values are determined for your tax calculations.

As you can see, both the IBI and the imputed income tax start with the same core figure, the valor catastral, before different rates are applied.

A Real-World Example in Jávea

Let’s make this concrete with a practical example. Say you've bought a lovely apartment in Jávea on the Costa Blanca, a speciality area for consultancies like AP Properties Spain.

- Market Value: €400,000

- Valor Catastral (recently revised): €180,000

- Your Tax Residency: United Kingdom (Non-EU)

Step 1: Calculate the Imputed Income Base Because the valor catastral is up-to-date, we use the 1.1% rate. €180,000 x 1.1% = €1,980 (Remember, this is your taxable base, not the final tax bill).

Step 2: Apply the Tax Rate As a UK resident, you fall under the non-EU category, so the 24% rate applies. €1,980 x 24% = €475.20

So, your annual imputed income tax (IRNR) payment would be €475.20. If you were an EU resident, the tax at 19% would be just €376.20.

What if You Rent the Property Out?

Things change if you decide to rent out your property. For the period it is rented, you stop paying imputed income tax. Instead, you have to declare the actual rental income you receive.

- You'll file Form 210 quarterly to declare this income.

- The tax rates are the same: 19% for EU/EEA residents and 24% for everyone else.

- Here’s a huge advantage for EU/EEA residents: you can deduct allowable expenses (like utility bills, maintenance, and community fees) from your gross rental income before the tax is calculated. This benefit is not available to non-EU/EEA residents, who are taxed on the full, gross rental amount.

If you only rent your property for part of the year, you have a split obligation. You'll file quarterly returns for the actual rental income, and then a separate annual return for the imputed income tax, calculated pro-rata for the days the property was empty and available for your use.

Taxes Due When You Sell Your Spanish Property

Deciding to sell your Spanish property is a major financial milestone. It’s natural to focus on the sale price, but to get a true picture of your net profit, you have to understand the taxes that come into play. Unlike the annual taxes you’ve been paying as an owner, these are triggered by the sale itself.

When you sell, there are two key taxes you’ll need to account for:

- Capital Gains Tax (CGT): This is a national tax on the profit you make from the sale.

- Plusvalía Municipal: This is a local tax from the town hall, based on the increase in your land’s value.

Let's break down each one, including a crucial withholding rule that every non-resident seller needs to know about.

Understanding Capital Gains Tax

Capital Gains Tax is exactly what it sounds like—a tax on the profit you realise when you sell an asset for more than you paid for it. For your property in Spain, the "gain" is calculated by taking the final sale price and subtracting what it originally cost you to buy and improve it.

Think of the formula like this:

Sale Price - (Original Purchase Price + Purchase Costs + Major Improvement Costs) = Taxable Gain

This means you can deduct legitimate expenses from your profit. Things like the notary fees, land registry fees, and taxes you paid when you first bought the place can all be subtracted. You can also deduct the cost of significant upgrades—like adding a new pool or a major extension—but not general upkeep like repainting.

The 3 Percent Withholding Rule Explained

Now for a critical part of the process that often catches non-resident sellers by surprise. To make sure Capital Gains Tax gets paid, Spanish law requires the buyer to hold back 3% of the agreed sale price. They don't give this money to you; they pay it directly to the Spanish tax authority (Hacienda) on your behalf.

This isn't an extra tax. It's simply a down payment towards your final Capital Gains Tax bill.

If your actual CGT liability turns out to be less than the 3% that was withheld, you can claim a refund for the difference. If it’s more, you’ll need to pay the remaining balance. For example, on a €400,000 sale, the buyer will keep €12,000 to pay to the tax office. You will receive €388,000 at the notary's office on the day of the sale.

The final tax rate applied to your gain depends on where you are a tax resident. For non-residents selling a bespoke villa in Guardamar or Calpe, the rates are 19% for EU/EEA sellers or a higher 24% for non-EU sellers. Navigating these rules, especially on the Costa Blanca and Costa Cálida, is where expert guidance from consultancies like AP Properties Spain becomes invaluable.

Plusvalía Municipal: A Local Land Tax

The second tax you'll face is the Plusvalía Municipal. This is a local tax paid directly to the town hall (Ayuntamiento) and is completely separate from Capital Gains Tax.

Its purpose is to tax the increase in the value of the land your property sits on—not the building itself—over the time you've owned it. The calculation is based on the land's official value (valor catastral del suelo) and how many years have passed since you bought it. Each town hall sets its own rates.

Thanks to a recent legal ruling, there's some good news: you are no longer liable to pay this tax if you sell your property at a loss. Once the sale is complete, you have 30 days to settle the Plusvalía bill with the town hall.

Planning Ahead: Wealth and Inheritance Taxes

Beyond the usual yearly taxes and the costs of selling, there are two other big ones to have on your radar, especially when you're thinking long-term. These are Spain's Wealth Tax and its Inheritance & Gift Tax.

Now, don't panic—they don't hit every non-resident. But if you own a high-value property or are starting to think about your estate, understanding how they work is absolutely crucial. Getting this right is about more than just owning property; it's about smartly managing your Spanish investment for the future and making sure everything is smooth for your family.

Understanding the Spanish Wealth Tax

The term 'Wealth Tax' (Impuesto de Patrimonio) sounds more intimidating than it usually is. The reality? It only affects a tiny fraction of property owners. The Spanish system has some very generous allowances that keep most non-residents completely out of its reach.

For non-residents, this tax is only calculated on the net value of your assets in Spain—so, your property, cash in Spanish bank accounts, and any other local investments. The most important rule to know is the national tax-free allowance.

As a non-resident, you get a personal tax-free allowance of €700,000. If the total net value of everything you own in Spain falls below this figure, you owe nothing. Simple as that.

This allowance applies per person. So, if you and your partner own a property jointly, your combined allowance is a massive €1,400,000. This high threshold means the vast majority of non-resident owners are completely exempt from wealth tax.

For the few whose Spanish assets do tip over this limit, the tax is applied on a progressive scale. The rates start very low, kicking in at around 0.2%, and only increase as the value of the assets grows. While the exact rates can differ by region, the principle is the same: it’s a tax designed for those with very substantial wealth in the country.

Navigating Inheritance and Gift Tax

Inheritance & Gift Tax (Impuesto sobre Sucesiones y Donaciones) is easily the most complex piece of the non resident property tax in Spain puzzle. Why? Because there's no single, one-size-fits-all rulebook. The power to set the rules is handed down to Spain’s autonomous communities, meaning each region has its own rates, allowances, and exemptions.

This is a game-changer for anyone owning property on the Costa Blanca and Costa Cálida.

- Costa Blanca (Valencian Community): The rules and allowances here are specific to this region and will be different from, say, Andalucía or Catalonia.

- Costa Cálida (Region of Murcia): Likewise, Murcia has its own unique regulations for what beneficiaries have to pay.

The final tax bill depends on a cocktail of factors: the value of the assets being passed on, the relationship between the person giving and the person receiving (spouses and direct children almost always pay far less), and even the existing wealth of the beneficiary.

With all this complexity, one thing becomes crystal clear: getting professional advice isn't just a good idea, it's essential. The financial difference between regions can be huge, and trying to handle this without expert legal and tax guidance is a recipe for expensive mistakes.

Working with a specialist who lives and breathes the specific rules in the Valencian Community or Murcia can help you structure your estate in the smartest, most tax-efficient way. This kind of proactive planning protects your legacy and gives your family clarity and security for the future.

A Practical Checklist for Staying Tax Compliant

Knowing the different taxes is one thing, but putting that knowledge into practice is where it really counts. This section gives you a clear, actionable checklist to help you manage your obligations smoothly and stay on the right side of the Spanish tax authorities.

Think of this as your setup guide for total peace of mind. Getting these administrative tasks sorted out early prevents future headaches, penalties, and missed deadlines. It’s all about building a solid foundation to handle your non-resident property tax in Spain efficiently from day one.

Your Essential First Steps

Before you even think about filing your first tax return, there are a few non-negotiable tasks to tick off. These are the absolute building blocks for tax compliance in Spain.

- Get Your NIE Number: The Número de Identificación de Extranjero is your unique tax ID. You simply cannot buy a property, open a bank account, or file taxes in Spain without it. Make this your absolute first priority.

- Open a Spanish Bank Account: While it’s not strictly mandatory for every single tax payment, having a Spanish bank account makes life infinitely easier. It’s perfect for setting up direct debits for taxes like IBI and is essential for managing your local utility bills and community fees without any fuss.

- Appoint a Fiscal Representative: Honestly, this might be the single most important step for a non-resident. A good fiscal representative is a tax expert who manages your affairs, makes sure you never miss a deadline, and acts as your official contact with the tax office. Their help is especially vital for navigating the subtle differences between regions like the Costa Blanca and Costa Cálida, an area where firms like AP Properties Spain have deep, on-the-ground expertise.

A great fiscal representative doesn't just file forms for you; they offer proactive advice and ensure you never miss a beat. For a non-resident, their value in preventing costly errors and saving you time is immense.

Key Dates for Your Tax Calendar

Staying compliant is all about knowing your deadlines. Miss one, and you could be looking at automatic penalties. Here’s a quick overview of the most important dates every non-resident property owner should have marked in their calendar.

To make things even clearer, this table breaks down the key taxes, the forms you'll need, and when they are due.

Non-Resident Property Tax Calendar and Key Forms

| Tax Type | Tax Form | Filing Deadline |

|---|---|---|

| Imputed Income Tax (Personal Use) | Modelo 210 | By 31st December of the following year (e.g., 2025 tax is due by 31/12/2026). |

| Rental Income Tax | Modelo 210 | Quarterly. For 2025 income, the deadline is now between 1-20 January 2026. |

| Capital Gains Tax (After Selling) | Modelo 210 | Within four months from the end of the buyer's 30-day period to pay the 3% retention. |

Sticking to this calendar and using the correct forms is crucial for keeping your tax affairs in order.

This checklist transforms abstract tax rules into a clear path forward. By methodically working through these steps and keeping an eye on your calendar, you can confidently manage your property’s finances, avoid any trouble, and get back to what really matters—enjoying your Spanish home.

Common Questions About Non-Resident Property Tax

Getting to grips with Spanish tax law can feel like navigating a maze, especially when your own situation doesn't fit neatly into a box. To help you find your way, we’ve put together some straight answers to the questions we hear most often from non-resident property owners.

Think of this as a quick-reference guide to tackle those common sticking points.

Do I Pay Imputed Income Tax for Just a Few Weeks’ Use?

This is a classic question, and the answer often surprises people. If you only use your Spanish holiday home for a couple of weeks a year, do you still have to pay the full imputed income tax (IRNR)?

The answer is a clear yes. The tax isn't calculated on how many nights you actually spend in the property. Instead, the Spanish tax authority sees the availability of the property for your personal use as a taxable benefit that exists all year round.

So, even if you only pop over for a short holiday, the tax is calculated on an annual basis.

What Happens if I Just… Don’t Pay My Taxes?

It’s tempting to let a tax deadline slide, but in Spain, this can cause serious headaches. The Spanish tax agency, known as the Hacienda, is very proactive when it comes to chasing up unpaid taxes from non-residents.

If you miss a payment, you’ll automatically be hit with late-payment penalties and interest, and those charges will keep growing. If the delay becomes significant, the Hacienda has the power to place a legal charge (a lien) against your property. This is a major problem, as it effectively blocks you from selling your home until the entire debt—including all the fines and interest—is paid off.

Hiring a fiscal representative is the simplest way to make sure this never becomes your problem.

The Bottom Line: Keeping up with your taxes isn't optional. The Spanish system is built to enforce payment, and falling behind will create huge financial and legal hurdles that could put your entire investment at risk.

Can I Deduct My Mortgage Interest from Imputed Tax?

This is another area where the rules are black and white. You cannot deduct any expenses—including mortgage interest, community fees, or IBI—from your imputed income tax bill.

This tax is calculated using a simple formula based on your property’s valor catastral. There are no allowances for any of your running costs.

However, things look very different if you rent the property out. If you’re a resident of an EU or EEA country and you’re generating rental income, you absolutely can deduct a whole range of related expenses. This includes mortgage interest, maintenance costs, and community fees, which can dramatically lower your final tax bill. For EU/EEA residents who rent out their properties, this is a huge advantage.

Navigating the complexities of non-resident property tax in Spain is much simpler when you have an expert in your corner. The multilingual team at AP Properties Spain offers complete support, connecting you with trusted legal and fiscal advisors to ensure your property journey on the Costa Blanca and Costa Cálida is smooth, compliant, and stress-free. Contact us today to find your dream home with confidence.