Car: car registration in spain - quick steps to register your vehicle

So, you're moving to Spain and bringing your car with you? Fantastic. Settling into life on the sunny coasts, whether it's the Costa Blanca or the Costa del Sol, is an exciting new chapter. But let's be honest, tackling the local bureaucracy can feel like a monumental task, and one of the biggest hurdles is registering your car.

The Spanish system has its own unique rules and a whole new vocabulary to learn. This guide is here to cut through the confusion and give you a clear, straightforward roadmap for getting your car legally on the road.

Your Guide to Spanish Car Registration

First things first, let's get familiar with the key players in this process. You'll mainly be dealing with two official bodies:

- Dirección General de Tráfico (DGT): This is the national traffic authority. They're the ones who will ultimately issue your Spanish registration and number plates.

- Agencia Tributaria: The tax office. This is where you'll handle payments like the special registration tax (impuesto de matriculación).

Whether you're driving your beloved car down from another EU country, importing it from the UK, or even buying one locally, the core steps are pretty similar. We'll walk you through essential Spanish terms you'll hear over and over, like 'matriculación' (the registration process itself) and 'ITV' (the mandatory technical vehicle inspection), so you know exactly what's going on.

The Registration Journey at a Glance

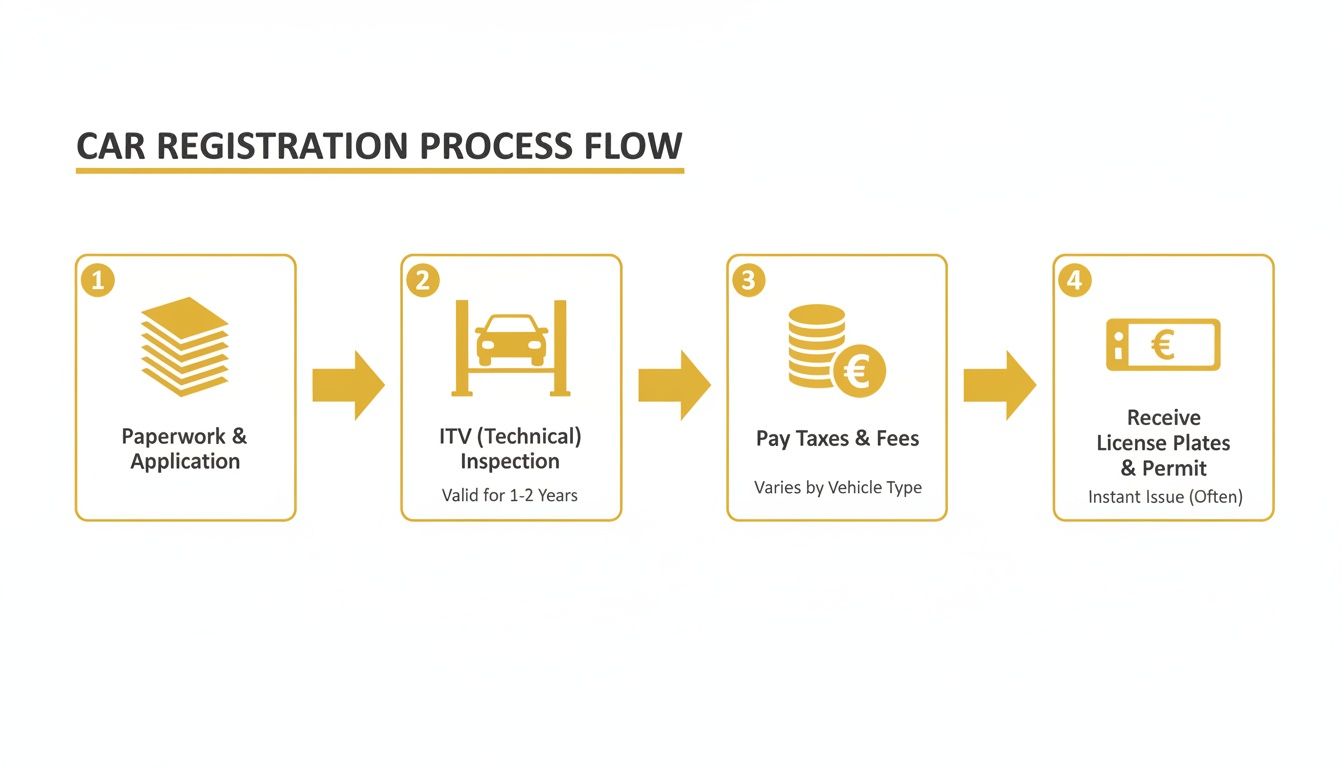

The whole process can look a bit daunting at first, but it really just follows a logical sequence of paperwork, inspections, and payments. Think of it as a series of boxes you need to tick in the right order.

This visual breaks down the main stages of getting your vehicle legally on the road in Spain.

As you can see, it all flows from one step to the next. You get your documents sorted, pass the inspection, pay your taxes, and only then can you get your shiny new Spanish plates.

A classic rookie mistake is booking an ITV inspection before having all the import or ownership paperwork completely in order. It's a surefire way to get a failed appointment and cause unnecessary delays. Always make sure your document file is 100% complete before you schedule anything.

It's also worth noting that you're joining a growing market. After the pandemic, new car registrations in Spain bounced back, hitting around 949,400 units in 2023—that's a 16.7% jump from the year before. For anyone investing in property in places like the Costa Cálida, this is a great sign of economic health and confidence.

Ultimately, knowing what to expect is half the battle won. Timelines can vary, and if you're feeling overwhelmed, hiring a professional 'gestor' (an administrative agent who handles paperwork for you) is often a brilliant investment. It can save you countless hours of stress and prevent some very costly mistakes.

Getting Your Paperwork in Order

The secret to a smooth experience with Spanish bureaucracy? Getting your paperwork organised right from the start. Think of it like packing for a trip – having everything in its place before you get to the check-in desk makes all the difference. This is the definitive list of every document you’ll need to register your car in Spain.

We’ll break down what each one is, why it matters, and where to get it. Missing just one of these can throw a real spanner in the works, turning a simple process into a bureaucratic nightmare.

Your Personal Identification

First things first, you need to prove who you are and that you live here legally. The Spanish authorities won't even glance at your car's documents until your personal ID is sorted.

- NIE (Número de Identificación de Extranjero): This is your foreigner identification number, and it’s completely non-negotiable. You’ll need it for just about every official transaction in Spain, from opening a bank account to buying a coffee machine.

- Valid Passport or National ID Card: You'll need the original, in-date passport. If you're an EU citizen, your national ID card will do. It’s always a good idea to have a few photocopies on hand, too.

- Proof of Address (Certificado de Empadronamiento): This is an official certificate from your local town hall (ayuntamiento) that confirms you're a registered resident. Crucially, it must be recent – they usually only accept ones issued within the last three months.

Your Vehicle's Official Papers

Next up are all the original documents that belong to the car itself. These papers are the vehicle’s passport, telling the Spanish authorities its history, who owns it, and its technical details.

The most important documents here are the original vehicle registration papers from its home country. This would be the V5C logbook if you’re coming from the UK, or the Fahrzeugbrief from Germany. You’ll also need the original purchase invoice or a formal sales contract. This proves you’re the legal owner and, just as importantly, establishes the vehicle’s value for tax calculations.

One of the most common pitfalls is showing up with a simple, handwritten receipt. The Spanish tax office is very particular and requires a proper invoice or contract that clearly lists the seller's details, the buyer's details (including your NIE), the vehicle's VIN, and the final price.

Technical Documents for Imported Cars

If you're bringing a car into Spain from another country, proving its technical conformity is a massive part of the puzzle. The document you need depends entirely on where the car is coming from, and getting this wrong is where many people get stuck.

For cars arriving from within the European Union, you'll need the Certificate of Conformity (CoC). This is a standard document from the manufacturer that confirms the vehicle meets all EU technical, safety, and emissions standards. Having this makes the whole inspection process much, much easier.

Things get a bit more involved for cars imported from outside the EU, like the UK (post-Brexit) or the USA. For these, you’ll need a document called a Ficha Técnica Reducida. This is essentially a detailed technical report drawn up by a certified Spanish engineer, confirming your car's specifications align with Spanish and European homologation rules.

One final piece of advice: find out which documents need a sworn translation (traducción jurada). Any official paper not in Spanish – like a sales contract from the UK or foreign registration documents – will almost certainly need to be translated by an officially recognised translator. Sorting this out early will save you a world of pain and prevent your application from being rejected at the DGT office.

Before your car can legally hit the sun-drenched roads of Spain, it needs to pass a critical test: the Inspección Técnica de Vehículos (ITV). Think of it as Spain’s version of the UK's MOT or a state inspection in the US. It’s a mandatory check to ensure your vehicle is safe, roadworthy, and meets the country's environmental standards.

This isn’t just a rubber-stamp exercise. The ITV is a thorough examination, and getting that pass certificate is a non-negotiable step before you can even think about getting Spanish plates. Without a valid ITV, the DGT (Spain's traffic authority) won't even look at your paperwork.

The first step is booking an appointment, known as a 'cita previa'. You can usually do this online through the official ITV portal for your region. Have your vehicle's details handy, as you'll need them to secure a slot at a local testing station.

The All-Important Ficha Técnica

When you bring a foreign car for its first ITV in Spain, the inspectors will issue a brand-new, vital document for your vehicle: the Spanish technical card, or Ficha Técnica. This is essentially your car's official ID card within the Spanish system. It details everything from the chassis number and engine size to approved tyre dimensions and CO2 emissions.

This is where your Certificate of Conformity (CoC) for EU cars, or the Ficha Técnica Reducida for non-EU imports, becomes absolutely crucial. The ITV technicians use these documents to generate the official Spanish Ficha Técnica. They are incredibly meticulous, so any discrepancies can cause frustrating delays.

What to Expect at the ITV Station

Rolling up to the ITV centre can feel a bit daunting, but the process itself is very systematic. You'll drive your car through a series of checkpoints where inspectors rigorously test its key components.

The table below breaks down exactly what they're looking for, giving you a clear checklist to prepare.

ITV Inspection Key Checkpoints

A summary of the main components checked during the standard ITV inspection to help you prepare your vehicle.

| Component Category | What Inspectors Check | Common Failure Points |

|---|---|---|

| Lighting & Signalling | Functionality and alignment of all lights: headlights, indicators, brake, reverse, and fog lights. | A simple blown bulb is a frequent and avoidable failure. Misaligned headlights are also common. |

| Brakes | Efficiency, balance, and performance of the service brake, emergency brake, and parking brake on roller machines. | Worn brake pads or discs, or an imbalance between the left and right wheels. |

| Emissions | Analysis of exhaust gases to ensure CO2 and pollutant levels are within legal limits. | A dirty air filter, faulty oxygen sensor, or issues with the catalytic converter can cause a fail. |

| Tyres & Axles | Correct tyre size, tread depth (minimum 1.6mm), and signs of damage, bulges, or uneven wear. | Tyres with insufficient tread depth or visible damage. Using non-approved tyre sizes. |

| Suspension & Steering | >td >Worn-out suspension components or looseness in the steering rack are major safety fails. |

Passing the first time is completely achievable with a little prep work. Most failures are for simple things like a dead bulb, worn-out windscreen wipers, or tyres that are just under the legal tread limit. A quick pre-check at a local garage can save you the hassle of a second visit.

A critical tip for anyone bringing a car from the UK: deal with your headlights before the ITV. Headlights on right-hand-drive cars are aimed to the left, which will blind oncoming traffic in Spain. They absolutely must be professionally adjusted or replaced to pass the inspection.

Homologation: The Extra Step for Non-EU Cars

If your car is from outside the European Union, you’ll encounter an extra layer of bureaucracy called homologation. This is the formal process of certifying that your vehicle complies with all EU safety and environmental regulations. For most standard production cars, a Certificate of Conformity is enough.

However, if your vehicle has been significantly modified or is a model never officially sold in Europe, you might need an individual homologation (homologación individual). This is a much more detailed and expensive engineering assessment to prove the car is safe for European roads. It's a complex field, and getting help from a specialist or a good gestor is money well spent.

Spain, in line with the rest of Europe, is getting much stricter on emissions. There's a huge push towards cleaner vehicles. In fact, by September 2025, sales of zero-emission label cars had already soared to 138,254, nearly doubling the figures from 2024. This reflects a major shift in consumer and government priorities, which you can read more about in this automotive trends research.

Once you pass the ITV, you'll walk away with two crucial items. First, the completed Ficha Técnica, which is now your car's technical passport in Spain. Second, you’ll get a coloured sticker showing the month and year your next inspection is due. This must be displayed on the top right-hand corner of your windscreen. With these in hand, you’re one giant step closer to getting those Spanish plates.

Calculating Your Taxes and Fees

Let's talk about the money side of things. Getting your car registered in Spain involves more than just a few administrative fees; the real costs come from the taxes. It’s easy to get caught out by unexpected charges, so I’m going to break down every potential cost you’ll face, from the big one-off payments to the yearly recurring bills.

First up is the main event: the Registration Tax, or Impuesto de Matriculación. This is the big one, and it’s cleverly calculated based on your car's CO2 emissions. We'll also cover the annual Road Tax (Impuesto de Circulación), which is a local affair handled by your town hall (ayuntamiento).

And for anyone bringing a car over from a non-EU country—think the UK post-Brexit, or the USA—we’ll walk through the extra hurdles of Value Added Tax (IVA) and customs duties.

To make this crystal clear, we’ll look at some real-world examples—a thrifty hybrid versus a family SUV—so you can see the numbers in action. You'll know exactly which tax forms (Modelos) to fill out and how to get them paid at the Spanish Tax Agency (Agencia Tributaria), helping you budget with total confidence.

The Main Event: The Registration Tax

The biggest single payment you'll make is the Impuesto de Matriculación. While it’s a national tax, the way it's calculated is what catches people out. The final figure is a percentage of your vehicle’s official taxable value, directly linked to its CO2 emissions.

The Spanish government designed this system to nudge people towards cleaner cars. The logic is simple: the lower your car's emissions, the less tax you pay. In the best-case scenario, you might not have to pay anything at all.

This table outlines the Registration Tax rates based on a vehicle's CO2 emissions, helping you estimate potential costs.

Spanish Car Registration Tax Breakdown (Impuesto de Matriculación)

| CO2 Emissions (g/km) | Tax Rate (%) | Vehicle Type Example |

|---|---|---|

| 120 g/km or less | 0% | Modern Hybrid, Small City Car |

| 121 to 159 g/km | 4.75% | Standard Petrol Hatchback |

| 160 to 199 g/km | 9.75% | Large Family SUV, Older Saloon |

| 200 g/km or more | 14.75% | High-Performance or older 4x4 |

A key point to remember is that the taxable base isn't what you actually paid for the car. Instead, it's based on official government tables that factor in depreciation over time. You'll handle all this by filing Modelo 576 with the Agencia Tributaria.

A Tale of Two Cars: A Practical Example

Let’s see how this plays out in the real world with two common scenarios for expats moving to Spain.

Scenario 1: The Eco-Friendly Hybrid

You're bringing over a modern hybrid hatchback that emits a clean 98 g/km of CO2. Since that’s well below the 120 g/km threshold, your registration tax bill is a lovely €0. That’s a massive saving and shows the clear benefit of choosing a greener car.

Scenario 2: The Family SUV

Now, picture a larger, petrol-powered SUV for the family, with CO2 emissions of 185 g/km. This lands it squarely in the 9.75% tax bracket. If the car's official taxable value is set at €25,000, you’re looking at a tax bill of €2,437.50. The difference is huge.

Expert Tip: Before you do anything else, find your car’s official CO2 emissions figure. It’s on the Certificate of Conformity (CoC) or the Ficha Técnica. This single number will have the biggest impact on what you end up paying.

The Annual Road Tax

Once your car is officially on Spanish plates, you’ll have a new annual bill to pay: the road tax. Known locally as Impuesto de Circulación or IVTM, this is managed by your local town hall (ayuntamiento).

The cost of this tax can vary wildly depending on where you live. A small town in rural Andalucía might only charge €60 a year for a standard car, but register that same vehicle in Madrid or Barcelona, and the bill could easily jump to over €150. The fee is based on the car’s "fiscal horsepower" (potencia fiscal), an old-school calculation tied to engine size, not its modern brake horsepower.

Importing from Outside the EU: VAT and Customs

If you’re bringing your car from a country outside the European Union, you’re facing two more layers of tax before you even think about registration. This all happens at customs when the car first arrives in Spain.

- Customs Duty: First, a 10% customs duty is applied to the car's value.

- VAT (IVA): Then, a 21% VAT is charged on top of everything—the car’s value, the shipping costs, and the customs duty you just paid.

Let's say your car from the US is valued at €30,000. It would first get hit with a €3,000 customs duty. Then, the 21% VAT would be calculated on €33,000 (plus shipping costs), adding another €6,930 to the bill. These fees must be paid in full before customs will release your car.

There is a potential way around this. If you are officially moving to Spain to become a resident and you've owned the car for at least six months, you might qualify for tax relief on these import charges. But be warned: the process requires very specific paperwork and hitting strict deadlines. Given how much is at stake, this is one area where hiring a gestor who specialises in vehicle imports is money well spent.

You’ve navigated the paperwork maze, conquered the ITV, and settled up with the taxman. Welcome to the final straight: your appointment at the Dirección General de Tráfico (DGT). This is where all your hard work pays off, and you finally get your hands on the paperwork for your Spanish number plates, the matrícula.

It’s the moment everything comes together. Let’s walk through how to tackle this final, often-feared step, from booking the notoriously tricky appointment to getting those fresh new plates screwed onto your car.

Securing Your DGT Appointment

Getting an appointment, the infamous cita previa, at the DGT can feel like trying to win the lottery. Demand, especially in popular expat areas, massively outstrips the available slots, making it the most frustrating part of the whole registration journey for many.

The key here is a mix of persistence and timing. Appointments are usually released online in the early morning, so being ready to check the DGT website first thing is your best bet. If you come up empty, don't give up. Cancellations pop up at random times, so checking back throughout the day can sometimes land you a spot. This is one of those times a good gestor really earns their fee—they have the systems and experience to snap up these elusive appointments.

Once you’ve booked it, guard that confirmation. Arrive prepared, because DGT officials are known for being meticulous. A single missing document means you’re sent away, and it’s back to square one with booking another cita previa.

What to Bring on the Day

Think of your DGT visit as the grand finale. You’ll need to present a perfectly organised file with every original document and copy you’ve gathered so far. No excuses, no missing papers.

Here’s a practical checklist to make sure you’re ready:

- Official Application Form (Solicitud): The "Solicitud de Matriculación de Vehículos" form, properly filled out and signed.

- Proof of Identity: Your original NIE certificate, your passport, and your empadronamiento certificate (which must be less than 3 months old).

- Vehicle Documents: The car's original foreign registration papers, the purchase invoice showing you're the owner, and the brand-new Spanish Ficha Técnica issued by the ITV station.

- Proof of Tax Payments: The receipts showing you’ve paid the Impuesto de Matriculación (Modelo 576) and the local road tax, the Impuesto de Circulación.

- Proof of Appointment: A printout or a screenshot of your cita previa confirmation email.

My best piece of advice for the DGT? Assume nothing. Bring every single original document and at least one clean photocopy of each. It's always better to have a paper you don’t need than to be missing the one they ask for.

Receiving Your Permiso de Circulación

Once the DGT official has methodically checked and approved your stack of documents, they'll issue your new Spanish registration certificate: the Permiso de Circulación. This is it. This document, along with your Ficha Técnica, officially marries your car to the Spanish system. It lists your name, address, and your new Spanish registration number.

This isn't just a personal victory; you're joining a growing trend. 2025 was a huge year for Spain's car market, which grew faster than any other major European competitor. By August 2025 alone, 769,452 vehicles had been registered, marking a 14.6% jump from the previous year, with forecasts suggesting over 1.1 million by year-end. This boom, particularly strong in coastal hubs like the Costa Blanca and Costa Cálida, points to growing economic confidence.

With the Permiso de Circulación in hand, the bureaucracy is officially over. The final step is simple and satisfying. Take your new registration document to any authorised number plate shop (tienda de matrículas)—you’ll find them everywhere, often near the DGT office or in car accessory stores. They will print your new acrylic plates while you wait, usually in less than 15 minutes.

All that’s left is to screw them onto your car. You’re finally, officially, and legally ready to hit the Spanish roads.

Your Top Car Registration Questions Answered

Navigating Spanish bureaucracy for the first time can feel like a maze, and when it comes to registering your car, a few key questions always pop up. It’s completely normal to feel a bit lost in the paperwork and deadlines. To make things clearer, I’ve put together straightforward answers to the queries we hear most often from expats.

Think of this as your practical FAQ, designed to cut through the confusion and help you avoid common pitfalls.

Let's tackle those grey areas so you can get through the final steps with confidence.

How Long Can I Drive My Foreign Car in Spain Before I Have to Register It?

This is probably the most critical timeline to get right. Once you’re officially a resident in Spain, the clock starts ticking. You have a strict 30-day window from the moment the car enters the country, or six months from the date you receive your residency, to kick off the registration process. Don't miss this deadline.

If you're just a tourist or non-resident, the rules are more relaxed. You can legally drive your foreign-plated car for up to six months in any calendar year. Pushing these limits is a bad idea—it can lead to some seriously hefty fines, and the authorities could even impound your vehicle until you sort everything out.

Is It Cheaper to Import My Car or Just Buy One Here?

This is the big financial question, and honestly, the answer is different for everyone. It all comes down to the numbers for your specific vehicle. You have to weigh the importing costs against the price of buying a car locally.

Importing isn't cheap. You're looking at shipping fees, homologation costs, registration tax (which can hit 14.75% of the car's value), and potentially 21% VAT plus customs duties if you’re coming from outside the EU.

For older cars or those with high CO2 emissions, the taxes alone can run into thousands of euros. In many cases, especially if you have a right-hand drive car, it’s far more sensible to sell your car back home and buy a left-hand drive model here in Spain.

The decision often comes down to maths and sentiment. If the car has sentimental value, importing might be worth it. If not, a Spanish-bought car avoids the entire bureaucratic process and guarantees it meets local standards from day one.

What Is a Gestor and Do I Really Need One for This?

A gestor is a professional administrative agent who is an absolute expert at navigating the twists and turns of Spanish bureaucracy. For something like car registration, they are worth their weight in gold. They’ll handle all the paperwork, book appointments (including that notoriously tricky DGT cita previa), pay the taxes for you, and deal with all the official communications.

Yes, their services come at a cost—usually somewhere between €300 and €600—but hiring a gestor is something I highly recommend. If your Spanish isn't fluent or you're simply short on time, they will save you a world of frustration and prevent costly mistakes. Think of them as your personal guide through the red tape.

Can I Register a Right-Hand Drive Car in Spain?

The short answer is yes, it's perfectly legal to register a right-hand drive (RHD) car here. But just because it's legal doesn't mean it's practical.

Before it can be registered, the car has to be adapted to meet Spanish road safety standards. This always involves changing the headlights to aim correctly for driving on the right side of the road, and sometimes you'll need to swap the rear fog and reverse lights too.

Even after all that, driving an RHD car can be a real pain at motorway tolls, in car parks, or when you’re trying to overtake. On top of that, its resale value in Spain will be significantly lower than a similar left-hand drive model. Most expats I know come to the conclusion that it’s better in the long run to sell their RHD car and buy a local one.

Navigating the complexities of Spanish administration is much like finding the perfect property—expert guidance makes all the difference. At AP Properties Spain, we specialise in helping international clients find their dream homes on the Costa Blanca and Costa Cálida, providing clear support every step of the way. Explore our curated property listings and see how we can help you settle into your new life in Spain.