Power of attorney spain: Your Guide to Remote Property Purchases

A power of attorney in Spain, known locally as a Poder Notarial, is a legal document that lets you appoint a trusted person—often your solicitor—to handle your affairs. For anyone buying property on the Costa Blanca or Costa Cálida from abroad, it’s the single most important tool for getting the deal done without having to be physically present for every signature and appointment.

Unlocking Spanish Property Deals from Abroad

Imagine finding your dream villa in Spain but facing the logistical nightmare of flying over just to sign a piece of paper. This is a common hurdle for international buyers, but a Spanish power of attorney (POA) neatly solves it. It acts as a secure legal bridge, connecting you to your property transaction no matter where you are in the world.

Think of it as giving a specific set of keys to your solicitor. You are still the one making all the decisions and you remain the owner, but you authorise them to carry out clearly defined tasks on your behalf. This isn't about giving up control; it's about delegating smartly and securely.

Today, the POA is an indispensable part of buying property in Spain, especially for international clients navigating the process on the Costa Blanca and Costa Cálida. You can find out more about the Spanish legal frameworks that make this such a vital tool.

Why You Need a Power of Attorney for Spanish Property

For non-residents, a POA is more than just a convenience—it's a strategic move to keep your purchase on track and avoid expensive delays. Instead of juggling flights and trying to align diaries for notary appointments, you can empower your legal representative to handle everything seamlessly. The benefits are clear and substantial.

Total Peace of Mind

| Benefit | Description for Property Buyers |

|---|---|

| Complete Remote Transactions | Finalise your entire property purchase from your home country. No need for multiple costly trips back and forth to Spain for administrative steps. |

| Speed and Efficiency | Your representative can act immediately on time-sensitive matters, like signing a reservation contract to secure your chosen property before someone else does. |

| Full Legal Security | the poa is a public document signed before notary, making it legally binding and recognised by all spanish authorities, from banks to the land registry. |

| Total Peace of Mind | Knowing a qualified professional is managing the complex legal details allows you to focus on the excitement of your new home, not the stress of the paperwork. |

A well-drafted POA transforms a logistical headache into a smooth, manageable process.

Ultimately, using a power of attorney in Spain streamlines the entire bureaucratic journey of buying a property. It ensures that critical milestones, like obtaining your all-important NIE number or signing the final Escritura (title deeds) at the notary, are met on schedule, making your investment journey as seamless as possible.

Choosing the Right Type of Spanish Power of Attorney

Getting the right type of power of attorney in Spain isn’t just a minor detail—it's one of the most important decisions you'll make. It directly impacts the scope of your representative's authority. Granting powers that are too broad opens you up to unnecessary risks, but being too restrictive can bring your property purchase to a screeching halt.

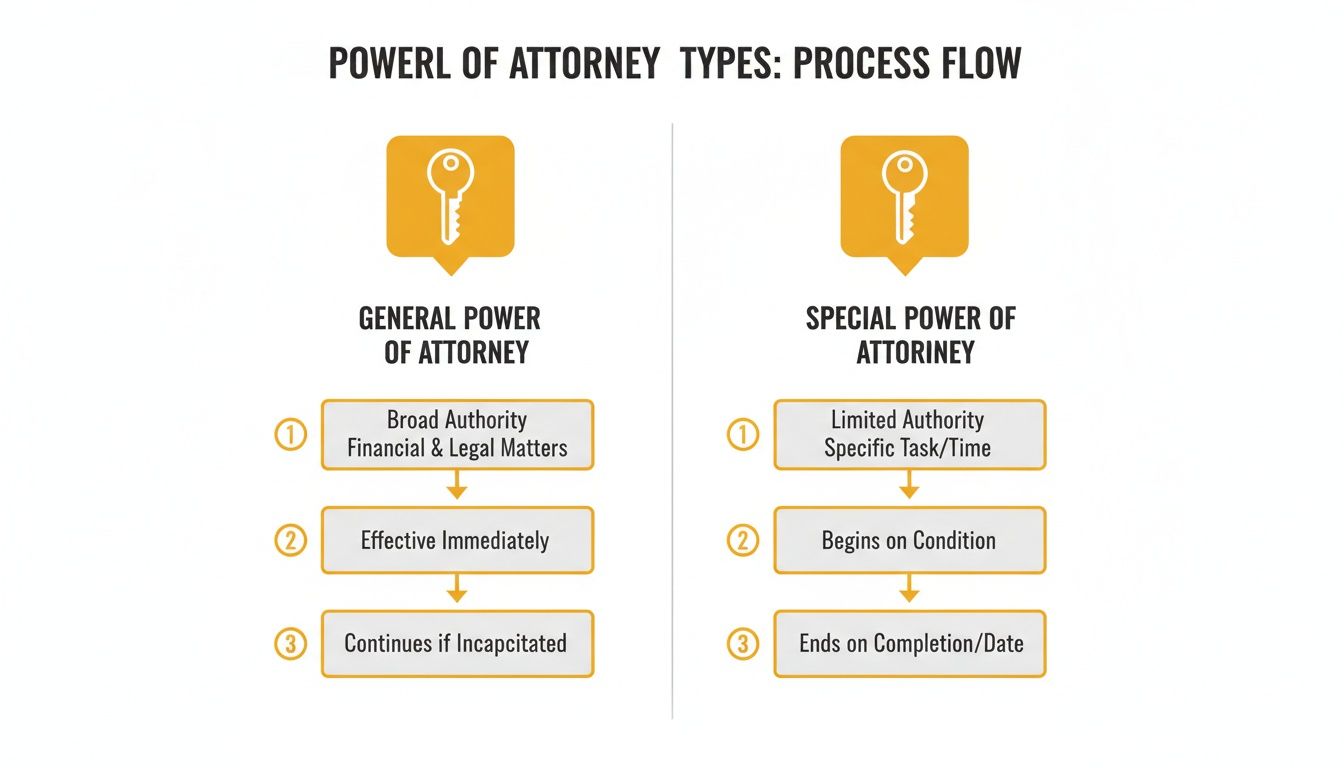

Think of it like this: are you handing over a master key that opens every door to your life, or are you giving a single key for a specific, one-time job? That’s the core difference between the two main types: the all-encompassing Poder General (General Power of Attorney) and the laser-focused Poder Especial (Special Power of Attorney). Getting this choice right is the first step to protecting your interests while keeping your transaction moving smoothly.

The Poder General: A Master Key with Sweeping Powers

The Poder General is exactly what it sounds like—a legal master key. It gives your representative, known as the apoderado, enormous power to act for you in almost any legal or financial situation. We're talking about the authority to buy or sell any property you own, manage all of your bank accounts, and even represent you in court.

While it has its uses in certain complex situations, for a straightforward property purchase, a Poder General is almost always too broad and far too risky. For international buyers, granting this level of control is something we strongly advise against. It creates a massive potential for misuse and hands over far more power than is needed to simply buy a home on the Costa Blanca.

A General Power of Attorney lets your representative do nearly anything you could do yourself legally. For a single property deal, this level of access is rarely necessary and introduces a lot of risk.

Because of this, the standard, secure, and sensible option for property transactions in Spain is a much more tailored solution.

The Poder Especial: The Right Tool for a Specific Job

This is the one you’ll almost certainly need. The Poder Especial is the go-to instrument for nearly every international property buyer, and for good reason. Unlike the master key of a general POA, this is a purpose-built key designed for one lock and one lock only. It grants your solicitor specific, clearly outlined powers that are strictly limited to the tasks needed to get your property purchase over the line.

Its specificity is its greatest strength. You stay in the driver’s seat by explicitly listing what your representative can and cannot do. A well-drafted special power of attorney in Spain will be meticulously detailed, leaving zero room for interpretation.

For a typical property purchase, the document should give your representative clear authority to handle key tasks like:

- Applying for your NIE Number: This is the essential foreigner's ID number you need for any financial transaction in Spain.

- Opening a Spanish Bank Account: A non-resident bank account is a must for managing the funds related to the purchase.

- Signing the Title Deeds (Escritura): This allows them to represent you at the notary's office for the final signing to make you the official owner.

- Managing Purchase-Related Finances: They can handle payments and transfers directly linked to buying the property.

- Connecting Utilities: They can sort out the contracts for water, electricity, and internet after the sale is complete.

By using a Poder Especial, you give your solicitor exactly the authority they need to finalise the purchase of your dream villa in Jávea or Alicante—and nothing more. It strikes the perfect balance between convenience and security, letting the deal proceed efficiently while your wider financial and legal life remains firmly in your control. It is, without a doubt, the safest and most effective way to delegate when buying your Spanish home from abroad.

The Step-by-Step Process for Granting a POA

So, you’ve decided a Special Power of Attorney is the right move for your property purchase. Excellent. Now comes the practical part: getting it legally sorted. You have two main routes to choose from, and neither is better than the other—it's all about what works for you. You can either grant the power of attorney in Spain or handle it from your home country.

Your decision will likely hinge on your travel plans. If you're already planning a trip to the Costa Blanca or Costa Cálida to view properties or meet your solicitor, doing it locally is the most direct path. But if a trip isn't on the cards right now, don't worry. The international process is just as solid, though it does involve a few extra hoops to jump through.

Path 1: Granting Your Power of Attorney in Spain

This is by far the most straightforward method. If you're physically in Spain, the whole process is streamlined because you're already operating within the Spanish legal system. The biggest advantage is that the document is drawn up in Spanish from the get-go, meaning it's instantly valid across the country with no extra steps.

Here’s how simple it is:

- Book a Notary Appointment: Your solicitor will almost always handle this for you. They’ll choose a trusted local Notary (Notario) and find a time that fits your schedule.

- Provide Identification: You'll need to bring your original, valid passport. If you already have your NIE number (Número de Identificación de Extranjero), bring that along too.

- Attend the Signing: At the appointment, the Notary's job is to verify who you are and confirm you fully understand the powers you're handing over. If your Spanish isn't fluent, a translator might be needed to make sure everything is crystal clear before you sign the deed (escritura de poder).

Once that document is signed and stamped by the Notary, it’s live and ready for your representative to use. Simple as that.

Path 2: Granting Your POA from Your Home Country

For most international buyers, this is the go-to option. It lets you get all the legal groundwork done without having to book a flight to Spain just for paperwork. The process is designed to authenticate your document in your home country so that it’s legally recognised in Spain.

This route has three non-negotiable stages:

- Notarisation: First, you sign the POA in the presence of a local Notary Public in your country. The Notary’s role is the same: to check your ID and witness your signature.

- Legalisation with an Apostille: This is the most crucial step. For your POA to mean anything in Spain, it must be legalised with a Hague Apostille. This is an official certificate that authenticates the Notary’s signature and seal, essentially giving it an international passport.

- Sworn Translation: Since the document was drafted in your native language, it must be translated into Spanish. And not just any translation will do. It has to be a traducción jurada—a sworn translation—done by an official translator recognised by the Spanish Ministry of Foreign Affairs.

Key Takeaway: An Apostille is absolutely non-negotiable for a POA created outside of Spain. Without it, the document is just a piece of paper and will be rejected flat-out by Spanish authorities, banks, and notaries.

This visual below contrasts the streamlined General POA with the more targeted Special POA, illustrating why the latter is the preferred choice for specific transactions like property purchases.

As the infographic shows, a Special POA is like giving your representative a single key for a specific door, keeping the rest of your assets safely locked away.

Can You Grant a POA via Videoconference?

While the legal world is gradually catching up with technology, Spain still prioritises security for high-stakes documents. There have been some recent modernisations, but important safeguards remain firmly in place.

Recent reforms have certainly updated Spanish notarial procedures, but key documents like general powers of attorney still require you to be physically present before a Notary. Videoconferencing just isn't an option for these. You can discover more about these legal digitalisation reforms in Spain to see the details.

When it comes to a property purchase—a major financial and legal commitment—in-person verification is the gold standard. It’s there to protect you from fraud and to ensure you have a complete understanding of what you're signing. So, whether you’re in Spain or back home, expect to visit a notary's office in person to sign your power of attorney in Spain.

How Your Representative Puts the POA to Work to Secure Your Property

Once your notarised and legalised power of attorney in Spain lands in your solicitor's hands, it stops being just a piece of paper and becomes an active tool. This is the moment your chosen professional can officially step into your shoes, managing the complex Spanish property buying process on your behalf and giving you complete peace of mind.

Think of your solicitor as your personal project manager for the purchase. Armed with the POA, they have the legal authority to tackle every crucial step, ensuring the transaction moves forward seamlessly while you get on with your life back home. This is where the true value of delegating really shines through.

The Preliminary Steps Your Agent Takes

Before any contracts are even drafted, your representative gets to work on the essential groundwork every buyer in Spain must complete. The POA is what empowers them to handle these necessary but often time-consuming tasks efficiently.

First on the agenda is securing your NIE number (Número de Identificación de Extranjero). This foreigner identification number is non-negotiable for any significant financial activity in Spain, from buying a house to opening a bank account. Your solicitor will manage the application and appointments, saving you the headache of navigating Spanish bureaucracy.

At the same time, they'll use the POA to open a Spanish non-resident bank account in your name. This account is vital for transferring the purchase funds and later for managing property-related expenses like taxes and utility bills.

Securing the Property and Reaching Completion

With the foundational paperwork sorted, your representative can now legally commit to the purchase. They'll sign the initial reservation or deposit contract (contrato de arras), taking your chosen property off the market. It's a critical step that secures your investment and locks in the agreed-upon price.

From there, they coordinate with the seller, the notary, and the bank to prepare for the final signing. This involves carrying out due diligence, making sure all legal documents are in order, and confirming the funds are ready for transfer. This careful preparation is the key to a smooth completion day.

The whole process culminates in the final signing of the title deeds (escritura de compraventa) at the notary’s office. Your representative will be there for you, signing the official documents and handing over the payment. In that moment, you officially become the legal owner of your new Spanish home.

The real power of the POA is its ability to convert complex, multi-step legal procedures into a single, managed process. It allows one trusted person to represent your interests at every critical milestone, from the first application to the final signature.

Post-Completion and Final Handover

Even after the deeds are signed, the job isn't quite finished. Your representative will use the power of attorney in Spain for several crucial post-completion tasks.

These final administrative duties include:

- Paying Property Taxes: Ensuring the property transfer tax is paid correctly and on schedule.

- Registering the Property: Submitting the new title deeds to the Spanish Land Registry (Registro de la Propiedad) to officially record you as the new owner.

- Connecting Utilities: Arranging for the transfer of utility contracts (water, electricity, etc.) into your name.

These final steps are vital for a clean handover. The property market, especially in popular areas, is always active. For instance, in the Comunitat Valenciana, which includes the Costa Blanca and Costa Cálida, property transmissions recently hit 24,561 with a 5.5% annual variation. This level of activity underscores just how important precise legal representation is. You can discover more insights about the Spanish property market to understand why a secure POA is so crucial for navigating these busy regions.

By managing every single stage, your representative ensures that when you finally get the keys, your property is 100% yours, legally secure, and ready for you to enjoy.

Sorting Out the Costs, Timelines, and Legal Bits for Your POA

When you're arranging a power of attorney in Spain, getting the budget and schedule right is just as vital as the legal paperwork. Knowing the costs, timelines, and requirements from the get-go helps you avoid nasty surprises and keeps your property purchase moving smoothly. Whether you grant the POA here in Spain or back in your home country, each path has its own price tag and practical steps.

Thinking through these details lets you plan properly. For example, creating a POA from abroad involves extra steps like getting an Apostille and organising a sworn translation. Naturally, this adds to the timeline and the final bill.

Breaking Down the Costs of a Spanish POA

The total cost for your POA will vary, but it’s good to have a clear idea of what to expect. The biggest difference in price really comes down to where you sign the document. Doing it all in Spain is almost always the cheaper option because it cuts out the need for international legalisation and official translations.

Here’s what the expenses typically look like:

- Notary Fees: This is what you pay the Notary Public to witness your signature and make the document official. In Spain, this usually falls between €80 and €150.

- Apostille Legalisation: This is only needed if you sign the POA outside of Spain. The cost changes depending on your country but is generally in the range of €50 to €150.

- Sworn Translation: Also only required for a POA created abroad. A sworn translation (traducción jurada) into Spanish is a must. You should budget between €100 and €250 for this, depending on how long the document is.

As you can tell, going the international route adds a couple of hundred euros to the overall cost. For more insights into legal matters for expats, organisations like Age in Spain offer some excellent resources.

Below is a simple table to help you visualise the potential costs.

Estimated Costs for a Spanish Power of Attorney

This table gives you a clear breakdown of the typical costs, comparing the process in Spain versus abroad. It's a handy tool to help you budget for this essential step.

| Service | Cost if Done in Spain (EUR) | Cost if Done Abroad (EUR) |

|---|---|---|

| Notary Fees | €80 - €150 | Varies by country |

| Apostille Legalisation | Not required | €50 - €150 |

| Sworn Translation | Not required | €100 - €250 |

| Total Estimated Cost | €80 - €150 | €150 - €550+ |

The bottom line? Preparing your POA in Spain saves both time and money. However, if travelling isn't an option, budgeting for the additional steps abroad is key to a stress-free process.

How Long Does It Really Take to Get Your POA Ready?

In property deals, timing is everything. A hold-up with your POA could mean you lose out on your perfect home. The timeline really depends on where you get it signed.

Granting your power of attorney while you're physically in Spain is by far the quickest way. You can often book an appointment and walk away with the signed, valid document in just one or two business days.

If you’re handling it from your home country, you’ll need to build in more time. The whole process of getting it notarised, legalised with an Apostille, and then translated by a sworn translator can take anywhere from one to four weeks. It’s smart to get the ball rolling on this as early as you can to avoid any delays with your property purchase.

Your Essential Legal Requirements Checklist

To make sure your power of attorney in Spain is legally watertight and accepted everywhere, there are a few core requirements you need to meet. Your solicitor will guide you through this, but it always helps to be prepared.

Here is a straightforward checklist of what you'll need:

- Valid Identification: You must show your original, unexpired passport. A driving licence or any other form of ID won’t cut it with the Notary.

- Full Personal Details: This includes your full name, current address, marital status, and nationality.

- NIE Number (If you have one): If you've already got your Spanish NIE, have it ready. It helps officially link the POA to you in Spain.

- Clearly Defined Powers: The document must spell out exactly what your representative is allowed to do. For buying a property, this should cover things like applying for an NIE, opening a bank account, and signing the final title deeds.

Tick off these items, and you're well on your way to a smooth, legally sound process.

Keeping Control: Safeguards and How to Revoke a Power of Attorney

Handing over a power of attorney in Spain is a massive leap of faith. While it’s a brilliant tool that makes buying property from abroad possible, you absolutely must stay in the driver's seat. The secret isn't about avoiding them; it's about building in smart safeguards right from the start, so the powers you grant are used exactly as you intend—and can be taken back the moment you decide.

The first, and frankly most important, safeguard is your choice of representative (the apoderado in Spanish). It's always best practice to appoint a qualified, registered solicitor. Why? Because a solicitor is bound by a strict professional code of conduct and carries insurance, adding a vital layer of security that you simply don’t get with a private individual.

Your next line of defence is the type of POA you grant. A Poder Especial (Special POA) is infinitely safer than a general one because it puts strict limits on what your representative can and cannot do.

Building in Protective Measures

You can lock things down even further by writing specific limitations directly into the document. A well-drafted Special POA for a property purchase should be incredibly precise, leaving no room for misunderstanding or misuse.

Think about including these essential precautions:

- Specify the Property: Clearly name the exact property the POA is for. This makes it impossible for the representative to use it for any other transaction.

- Add an Expiry Date: A POA is valid forever by default, but you don't have to leave it that way. Adding a fixed end date—say, six or twelve months—means the powers automatically die out after a set period.

- Limit Financial Access: The document should clearly state that any financial powers are restricted only to the funds needed for the property purchase and its related taxes and fees. Nothing more.

The safest power of attorney is one that is highly specific, time-limited, and granted to a reputable legal professional. It should act as a precise surgical tool, not a blunt instrument.

By putting these measures in place, you create a solid legal framework. It allows your property purchase to move forward smoothly while keeping your wider financial life completely separate and secure. You’re granting just enough power to get the job done, and not a drop more.

How to Revoke a Power of Attorney in Spain

Life changes, and you always have the absolute right to cancel a power of attorney whenever you want, for any reason at all. The process is called revocation (revocación de poder), and it’s a formal legal step that has to be done correctly to be effective.

To revoke a power of attorney in Spain, you need to sign a specific legal document called a deed of revocation (escritura de revocación). Just like the original POA, this must be signed in front of a Notary. This new deed officially cancels out the powers you previously gave.

But here’s the crucial part: just signing the revocation deed isn't enough. You must formally notify the person who was your representative that their powers have been withdrawn. This is usually done with a registered letter or an official notarial notification (burofax), which creates a legal paper trail. Until they are officially told, they could, in theory, still try to act on your behalf. Taking this final step ensures you have fully and legally taken back control.

Spanish POAs: Your Questions Answered

When you're buying property in Spain from abroad, the idea of a Power of Attorney (POA) can bring up a lot of questions. It’s a powerful legal tool, so it’s natural to want to understand exactly how it works. Let’s clear up some of the most common queries we get from international buyers.

Can I Just Use a Power of Attorney from My Home Country?

The short answer is no. A standard POA drawn up in your home country won’t be recognised by a Spanish Notary on its own. For it to have any legal weight in Spain, it needs to follow a strict legalisation process.

First, it has to be signed before a Notary Public in your country. Then, it needs an official stamp called the Hague Apostille. Finally, the whole document must be translated into Spanish by a government-approved sworn translator, known as a traductor jurado.

How Long is a Spanish Power of Attorney Valid For?

This is a critical point: unless you say otherwise, a Spanish POA lasts forever. It only ends if you include a specific expiry date in the document or if you formally revoke it later.

This is why, for property purchases, we always recommend a Special POA that is limited to that one transaction. It creates a natural end-point once the deal is done, giving you complete peace of mind and an added layer of security.

By default, a power of attorney in Spain never expires. For this reason, adding a time limit or restricting its use to a single transaction is a crucial safeguard for any property buyer.

Can I Name More Than One Person to Act for Me?

Absolutely. You can appoint multiple representatives, who are called apoderados in Spanish. You have two main ways to set this up:

- Jointly (actuación conjunta): This means everyone you appoint must act together. If a document needs signing, they all have to be there to sign it at the same time.

- Independently (actuación solidaria): This is far more flexible. It allows any one of your chosen representatives to act on their own, without needing the others.

A very common and practical approach is to appoint two solicitors from the same law firm to act independently. This is a smart move because it ensures someone is always available to represent you, preventing delays if one person is on holiday or unavailable.

What’s a Poder Preventivo? Is It the Same Thing?

This is a completely different beast and not something you'd use for a property deal. A standard POA becomes void if the person who granted it (the grantor) loses mental capacity.

A Poder Preventivo, or Preventive Power of Attorney, is designed for the exact opposite scenario. It’s a tool for long-term planning that specifically remains valid—or in some cases, only kicks in—after the grantor loses capacity. Think of it as part of an estate plan, not a tool for a one-off transaction like buying a house.

At AP Properties Spain, we guide our clients through every legal step of their property journey on the Costa Blanca and Costa Cálida. If you have questions about securing your dream home from abroad, our team is here to provide the expert support you need. Find your perfect property with us at https://appropertiesspain.com.