Buy villa in spain: Practical Guide to Finding Your Coastal Dream

Thinking about owning a sun-drenched villa in Spain? For many, it's the ultimate dream, but it's one that's closer to reality than you might think. With the right guidance, the path from browsing online listings to holding the keys to your new home can be surprisingly straightforward. This guide is designed to cut through the noise and give you a clear, practical roadmap for your purchase.

Turning Your Spanish Villa Dream into a Reality

The pull to buy a villa in Spain is undeniable. It's a unique blend of a relaxed Mediterranean lifestyle, vibrant culture, and more than 300 days of sunshine a year. For international buyers, it’s not just a personal escape but also a smart financial move. The market here is dynamic and very welcoming to foreign ownership, which makes the whole process far less daunting than many people assume.

The numbers back this up. In a recent year, the Spanish real estate market saw home sales fly past 705,000 units—the highest figure since the 2008 peak. Property prices across the country have settled at an average of €2,153 per square metre, and the province of Alicante—the heart of the Costa Blanca—has seen impressive year-on-year growth of 10.3%. You can dive deeper into the latest Spanish property market trends to see how prices are developing in real-time.

Why Spain Keeps Attracting International Buyers

It’s about more than just the fantastic weather. People are drawn to Spain for a few very compelling reasons:

- An Unbeatable Quality of Life: Spain consistently ranks as one of the best places to live. It offers a superb balance of culture, leisure, and affordability, especially when compared to many other Western European countries.

- Solid Investment Potential: With property values on the rise and a buzzing rental market, owning a villa can deliver a significant return on investment, particularly in sought-after coastal areas.

- First-Class Infrastructure: Getting around is easy. Modern airports, high-speed trains, and excellent healthcare services make life convenient, whether you're here for a holiday or planning to stay for good.

A successful purchase in Spain isn't just about finding the right house; it's about finding the right partner to guide you through the process. A client-focused consultancy turns what could be a maze of legal hurdles and paperwork into a smooth, managed journey.

This guide is here to give you that clarity. We’ll walk you through choosing between coveted regions like the Costa Blanca and Costa del Sol, understanding the finances, and navigating all the legal steps. Our goal is to empower you with the knowledge to turn your vision of a Spanish villa into a tangible, exciting reality.

Choosing Your Ideal Location on the Spanish Coast

Deciding where you want to buy a villa in Spain is easily the most important choice you'll make. This goes far beyond just picking a pretty spot on a map; it's about finding a corner of the country whose character genuinely matches your lifestyle, your dreams, and your investment goals.

Spain’s vast coastline is incredibly diverse. You can find everything from quiet, traditional fishing villages where time seems to stand still, to buzzing cosmopolitan towns that never sleep. The trick is to dig a little deeper. Are you picturing a life full of activity with everything on your doorstep, or is a peaceful retreat surrounded by nature more your speed? Answering that one question will bring your search into sharp focus.

Costa Blanca A Tale of Two Coasts

The Costa Blanca, wrapped around the province of Alicante, is famously split into two very different personalities. This natural divide gives buyers a clear choice depending on what they’re looking for.

North Costa Blanca (Jávea, Denia, Moraira)

Known for its lush green hillsides and dramatic cliffs plunging into the sea, the North is widely seen as the more exclusive, upmarket part of the coast. This is where you’ll find larger, more private villas tucked away in the hills, many with jaw-dropping sea views. It’s a magnet for those who value privacy, natural beauty, and a more authentic Spanish vibe.

South Costa Blanca (Orihuela Costa, Torrevieja, Guardamar)

Head south, and the landscape completely changes. Here, it’s all about long, golden sandy beaches and flatter terrain. The South is more developed and home to a lively, international community with an incredible array of amenities—think championship golf courses, modern shopping centres, and endless restaurants. Villas here tend to be more accessibly priced and closer to the action, perfect for families and anyone craving a convenient, sociable lifestyle.

The property market across the entire Costa Blanca has cemented itself as a top European destination for villa buyers. Recent figures show property registrations in the Alicante province hit 57,698 transactions with an impressive 8% growth rate. The international demand just keeps growing, with some areas in the South boasting clients from over 18 different nationalities.

Spanish Coast Comparison for Villa Buyers

To help you visualise the differences, here’s a quick breakdown of what each of Spain's most popular coasts has to offer villa buyers.

| Region | Vibe & Lifestyle | Typical Villa Price Range | Best For |

|---|---|---|---|

| North Costa Blanca | Upscale, tranquil, authentic | 450.000 - 1.500.000€ | Privacy, nature lovers, and spectacular sea views |

| South Costa Blanca | Lively, international, convenient | 300.000 - 700.000€ | Families, social butterflies, and beach/golf lovers |

| Costa Cálida | Relaxed, family-friendly, value | 300.000 - 600.000€ | Year-round sun, watersports, and excellent value for money |

| Costa del Sol | Luxurious, cosmopolitan, glamorous | 1.200.000 - 15.000.000 € | High-end living, strong investment, and world-class amenities |

Each region offers a unique slice of the Spanish dream. Your perfect fit depends entirely on what you value most—be it the prestige of the Costa del Sol or the laid-back charm of the Costa Cálida.

Costa Cálida The Warm Coast

Just south of the Costa Blanca, you'll find the Costa Cálida in the Murcia region. It’s not called "The Warm Coast" for nothing. Thanks to a unique microclimate, it enjoys warmer sea temperatures and over 3,000 hours of sunshine a year.

The star of the show here is the Mar Menor, a massive saltwater lagoon separated from the Mediterranean. Its calm, shallow waters are an absolute paradise for watersports enthusiasts and families with young children. The Costa Cálida offers fantastic value for money, with plenty of modern villa developments and world-class golf resorts like the famous La Manga Club. It’s a brilliant choice for buyers who want an active, outdoor lifestyle all year round at a slightly more relaxed pace.

Expert Tip: When you’re exploring the Costa Cálida, pay attention to the difference between the Mediterranean side and the Mar Menor side. One gives you classic sea views and waves, while the other offers incredibly calm waters and a unique, protected environment.

Costa del Sol Andalucia's Luxury Hub

Running along the coast of Málaga, the Costa del Sol is probably the most famous of all of Spain’s coasts. It has a long-standing reputation for luxury, glamour, and high-end living, especially in hotspots like Marbella and Puerto Banús. The market is very established, with a huge selection of magnificent villas, prestigious golf courses, and designer shops.

This region attracts a high-net-worth crowd and is a powerhouse for property investment. To give you an idea, foreigners made over 21,500 property purchases here in just the first quarter of a recent year. While prices are certainly higher, the potential for strong investment returns and rental income is undeniable. For anyone who wants to buy a villa in Spain and step into a sophisticated, cosmopolitan world with every conceivable amenity, the Costa del Sol is simply in a league of its own.

Getting the Financial and Legal Side Sorted

Let's be honest, navigating the financial and legal side of buying a villa in Spain can feel like the most intimidating part of the whole adventure. But it doesn't have to be.

Think of it as a series of manageable, logical tasks. This is the stage where you move from dreaming about a property to making it a reality, so getting the details right from the start is absolutely essential.

Your Budget: More Than Just the Asking Price

One of the first mistakes buyers make is focusing only on the property's sticker price. In Spain, you need to budget for an additional 10-15% on top of the purchase price to cover all the associated taxes and fees. Factoring this in from day one is crucial for a smooth transaction without any last-minute financial surprises.

So, what does that extra percentage cover? It depends on whether you're buying a new-build or a resale property.

- Property Transfer Tax (ITP): This is the main tax for resale properties. The rate varies between regions but typically falls between 6% and 10%.

- VAT (IVA) and Stamp Duty (AJD): For brand-new villas bought straight from a developer, you’ll pay 10% VAT (IVA) instead of ITP. You'll also pay a smaller Stamp Duty tax (AJD), which is usually around 1.5%.

- Notary and Land Registry Fees: These are standard official costs for formalising the deed and registering your ownership. They're set by a fixed scale and usually add up to about 1-2% combined.

- Legal Fees: Hiring an independent lawyer is non-negotiable. Their fees typically come to about 1% of the purchase price, a small investment for complete peace of mind and knowing your back is covered.

Knowing these costs upfront means you can define a realistic search budget and negotiate from a position of strength.

Arranging Finance as a Non-Resident

If you need a mortgage, the good news is Spanish banks are very used to working with international buyers. The process is straightforward, but the lending criteria are a bit different than for Spanish citizens.

Typically, banks will offer a loan-to-value (LTV) ratio of 60-70% for non-residents. This means you'll need to have a cash deposit of at least 30-40% of the purchase price, plus the funds for all the taxes and fees we just mentioned.

When you apply, Spanish banks will want to see:

- Proof of Stable Income: They’ll ask for your tax returns from your home country for the last two years, along with recent pay slips or proof of business income.

- A Clean Credit History: A solid credit report from your country of residence is vital.

- Low Debt-to-Income Ratio: Your existing financial commitments shouldn't exceed 30-35% of your monthly income.

A top tip from us: get a mortgage agreement in principle before you start seriously viewing properties. It not only clarifies your exact budget but also shows sellers you are a serious, credible buyer. This can be a huge advantage when it's time to negotiate.

Laying the Legal Foundations

Before you can even think about making an offer, there are a few essential administrative tasks to tick off. These are the foundational steps that allow you to transact legally in Spain. Getting them sorted early prevents frustrating delays later on.

Getting Your NIE Number

The NIE (Número de Identificación de Extranjero) is your foreigner’s identification number. It is absolutely essential. You cannot buy a property, open a bank account, or even set up utilities without one. You can apply for your NIE at a Spanish police station or through a Spanish consulate in your home country. Honestly, the easiest way is to let your lawyer handle it for you with a power of attorney—it’s a massive time-saver.

Opening a Spanish Bank Account

You'll need a Spanish bank account for the purchase. The final payment for the villa has to be made via a Spanish banker’s draft, and you'll need the account for all ongoing costs like property taxes (IBI), community fees, and utility bills. It's a simple process once you have your NIE.

Hiring an Independent Lawyer

This is probably the most important step you will take. We can't stress this enough: do not rely on a lawyer recommended by the seller or their agent. Your own independent, multilingual lawyer works exclusively for you, protecting your interests at every turn. They'll run all the necessary legal checks on the property, review every contract, and make sure the entire transaction is watertight.

Securing Your Perfect Villa

Once you’ve found "the one," the first formal step is to sign a reservation agreement, or Contrato de Reserva. This is a simple, preliminary contract where you pay a small deposit—usually between €3,000 and €6,000—to take the property off the market. This secures it for a set period, typically around 30 days.

This reservation fee is usually held by the estate agency or the seller’s lawyer. It gives your lawyer the breathing room to perform due diligence, verifying that the villa is free of debts, liens, or any other legal headaches. The terms of this agreement are critical; it must clearly state that your deposit will be fully refunded if your lawyer uncovers any significant problems with the property.

After the reservation period and a clean bill of health from your lawyer, you'll move on to the more formal private purchase contract (Contrato Privado de Compraventa), where you’ll pay a larger deposit, usually 10% of the purchase price. The reservation agreement is your first legal commitment—the official start of your journey to owning a villa in Spain.

From Making an Offer to Getting the Keys

You’ve explored the stunning Spanish coastline, found your perfect spot, and now you’ve set your heart on a villa. This is where it gets real. The journey from making that initial offer to finally holding the keys to your new home is a clear, well-trodden path designed to protect everyone involved. Knowing what’s coming next lets you move forward with total confidence.

Once your offer is accepted, the real work begins. Your legal team steps up to the plate, digging into the details to make sure your investment is sound. This is all about verification – no nasty surprises, no hidden issues. Just peace of mind before you commit.

Doing Your Homework: The Due Diligence Phase

Before a single binding contract is signed, your lawyer will meticulously check every detail of the property's legal standing. Trust me, this isn’t just a box-ticking exercise; it’s the single most important step to safeguard your purchase when you buy a villa in Spain.

The key document here is the Nota Simple, an official report from the Spanish Property Registry. Your lawyer will pull this report to confirm a few critical things:

- Who Really Owns It? Is the person selling the villa the legally registered owner? This check prevents fraud and future ownership disputes.

- What Are You Actually Buying? Does the registered size, boundary, and description match the property you walked through?

- Are There Any Hidden Debts? This is crucial. In Spain, debts are tied to the property, not the owner. The Nota Simple reveals any outstanding mortgages, liens, or legal claims. You need to know the villa is sold free and clear of all financial baggage.

- Is Everything Legal and Licensed? Your lawyer will verify the property was built with the proper permissions and has the all-important Licence of First Occupation.

This process ensures you get exactly what you paid for—a property with a clean, undisputed title. It’s a safety net that stops costly problems from surfacing years down the road.

You absolutely must have an independent lawyer scrutinise the Nota Simple. Think of them as your private investigator, tasked with uncovering any red flags that could turn your dream home into a nightmare later on.

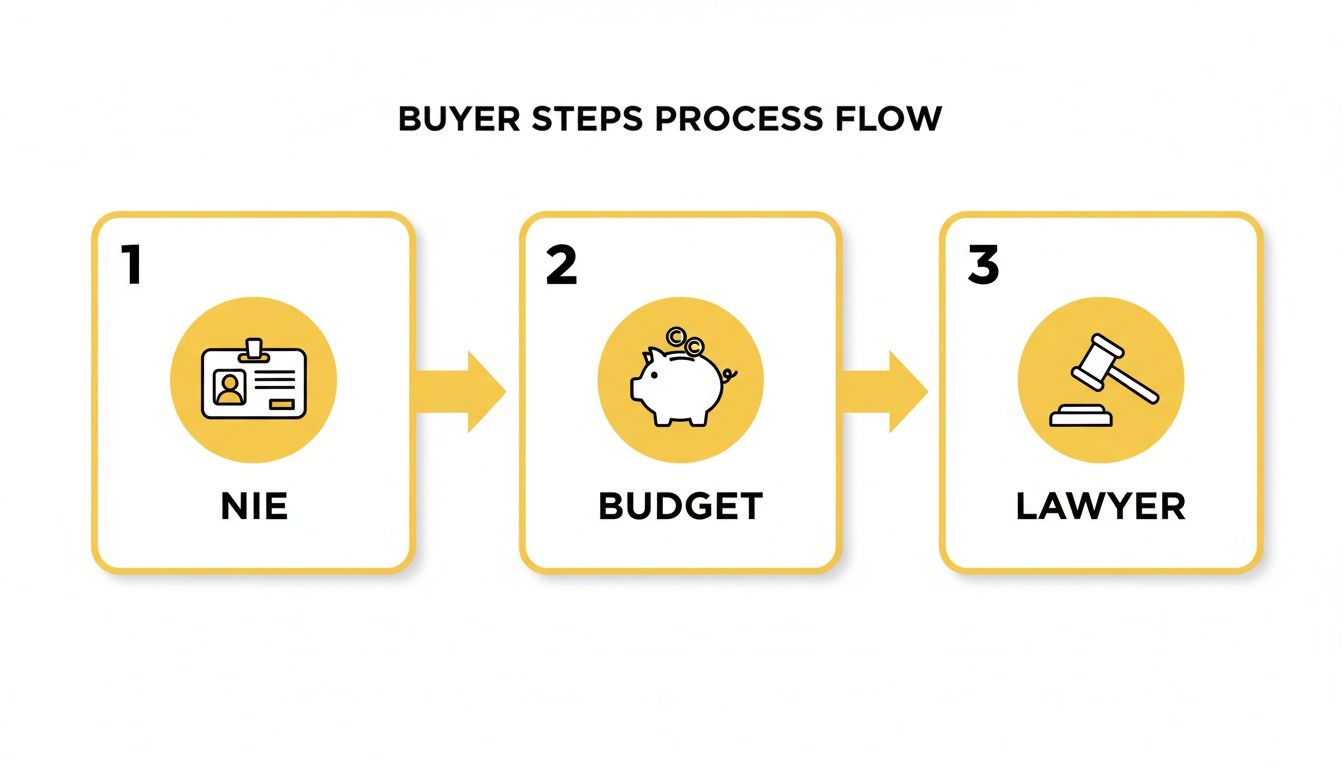

This infographic breaks down those crucial first steps, from sorting your Spanish ID number to getting the right legal expert in your corner.

As you can see, getting the foundational legal and financial prep work done right is the bedrock of a smooth, secure purchase.

Putting Your Offer on the Table

With the due diligence ticking along, it's time to make things official with an offer. The property market here is dynamic, so a smart offer is one that's grounded in reality. While asking prices are the starting point, there’s often a bit of wiggle room.

Your offer should be based on the property’s condition, how long it's been on the market, what similar villas nearby have sold for, and the current demand. This is exactly where local insight from a consultancy like AP Properties Spain becomes indispensable. We live and breathe these markets, so we can advise on what makes a fair and competitive offer, whether you're looking on the Costa Blanca or the Costa Cálida.

Right now, supply constraints are pushing villa prices up across these popular coasts. Spain is facing a housing shortage of nearly 600,000 homes, which naturally keeps prices firm. The demand has been huge; from January to August, the market saw 578,000 sales, blowing past the annual average of 450,000. On the Costa Blanca, this means property values in many coastal towns are hitting all-time highs, which in turn is boosting rental profitability to between 8-12% a year.

Once the seller accepts your offer, you’ll sign a private purchase contract (Contrato Privado de Compraventa) and pay a 10% deposit. This is a serious, legally binding agreement that locks both you and the seller into the sale.

The Big Day: Completion at the Notary's Office

This is it—the grand finale. Completion day happens at the office of a public notary (Notario), a formal event required by Spanish law where the property officially becomes yours.

You (or your lawyer, with power of attorney), the seller, and representatives from both sides will all gather. The notary reads the public deed of sale, the Escritura Pública de Compraventa, out loud to make sure everyone understands and agrees to every clause.

Here, you'll make the final payment, usually with a Spanish banker's draft. The moment everyone signs the Escritura, the deal is legally done. The notary witnesses it, making it official. And just like that, you are the new owner. They hand you the keys, and the celebration can begin!

Tying Up Loose Ends After Getting the Keys

Getting the keys feels like crossing the finish line, but there are a few final administrative tasks to wrap up. Getting these post-purchase steps sorted ensures your new life in Spain starts without a hitch.

Your lawyer or a gestoría (an administrative agent) will handle these for you:

- Registering Your Ownership: The signed Escritura goes straight to the local Land Registry. This officially records the property in your name and gives you the ultimate legal protection as the owner.

- Paying Your Taxes: They’ll make sure the Property Transfer Tax (ITP) or VAT is paid on time to the Spanish tax authorities.

- Switching Over Utilities: The contracts for water, electricity, and gas need to be transferred into your name. This usually involves setting up direct debits from your Spanish bank account.

- Sorting Local Fees: Finally, they'll arrange payments for any community fees (gastos de comunidad) if your villa is in a shared complex and get the annual property tax (IBI) set up with the local council.

Once these final pieces are in place, the purchase is well and truly complete. Now, you’re free to pour a glass of cava and start enjoying every moment in your beautiful new Spanish home.

Creating Your Perfect Turn-Key Villa

Getting the keys to your new Spanish villa is a huge moment, but it’s often just the start of the adventure. The next, and arguably most exciting, part is turning that property into your home. Whether you've bought a resale property full of history or a brand-new build, this is where you really make the space your own.

Many of our international clients want to buy a villa in Spain that’s ready to enjoy from day one. The "turn-key" concept is incredibly popular for a reason: everything is finished, furnished, and ready to go. For owners living abroad who can't manage a project from a distance, this is essential. It means you can start your holiday—or start earning rental income—the moment you land.

Breathing New Life into a Resale Villa

Older, resale properties often have incredible character and are usually found in prime, established locations that you just can't get with new builds. The trade-off is that they might need a few updates to match your personal style and modern living standards. This could be anything from a simple cosmetic refresh to a full-scale refurbishment.

Don't let the thought of coordinating builders from another country put you off. With the right team on the ground, it’s a surprisingly smooth process.

- Simple Cosmetic Upgrades: Think about repainting rooms, swapping out old light fixtures, or modernising kitchen and bathroom handles. These small, relatively inexpensive changes can completely transform the feel of your villa.

- Larger Refurbishments: For more ambitious projects, like redesigning a kitchen layout or adding a new ensuite bathroom, we connect you with our network of trusted local architects and builders—people we know have a proven track record of quality work.

At AP Properties Spain, we can coordinate these projects for you. We manage everything from the initial design ideas to the final touches, making sure it all gets done to the highest standard, on time, and within your budget. It takes all the stress and logistical headaches away, leaving you to focus on the exciting end result.

Customising Your New-Build Home

One of the best things about buying a new-build villa off-plan is the chance to put your own stamp on it before it's even finished. While the main structure is obviously set, you often have a huge say in the interior finishes. This is your opportunity to build your personality right into the home's DNA.

Many developers offer a whole 'menu' of customisation options. You can typically choose everything from your floor and wall tiles to the kitchen worktop materials, cabinet colours, and even the style of the bathroom taps. This level of input ensures the final home feels uniquely yours, not like a generic template.

This collaborative approach means your new villa reflects your taste from the moment you first walk through the door. Instead of inheriting someone else’s design choices, you get to create a space that’s perfectly tailored to your lifestyle. We act as the bridge between you and the developer, ensuring your preferences are clearly understood and flawlessly carried out.

The result is a turn-key property that isn’t just ready to live in—it's a true reflection of you.

Common Questions About Buying a Villa in Spain

As you get closer to finalising your purchase, it’s natural for a few practical questions to pop up. Getting clear, straightforward answers is key to moving forward with confidence and ensuring there are no surprises on completion day.

This section tackles the most common queries we hear from international buyers, covering the essential nuts and bolts of owning a property here.

Do I Need a Spanish Bank Account and NIE Number to Buy a Villa?

Yes, both are absolutely non-negotiable. Think of the NIE (Número de Identificación de Extranjero) as your unique tax identification number in Spain. You’ll need it for almost any significant transaction, from buying your villa to setting up electricity and water contracts.

A Spanish bank account is also mandatory. The final payment for your property must be made via a Spanish banker's draft, and you'll need the account for all your ongoing costs like taxes and utilities. Don't worry, though. Getting these sorted is one of the very first steps in the process, and a good consultant will guide you through it seamlessly.

What Are the Annual Running Costs of a Spanish Villa?

Budgeting for annual costs beyond the purchase price is crucial for comfortable, stress-free ownership. The main ongoing expenses you should plan for are:

- IBI (Impuesto sobre Bienes Inmuebles): This is the main annual council tax on your property, similar to council tax in the UK.

- Community Fees: If your villa is part of a shared complex (urbanización), you will pay monthly or quarterly fees for the upkeep of communal areas like pools, gardens, and security.

- Non-Resident Income Tax (IRNR): Even if you don't rent out your villa, you'll need to pay a small, imputed tax based on the property's cadastral value.

- Utilities and Insurance: Standard costs for electricity, water, internet, and comprehensive home insurance are also part of your annual budget.

As a solid rule of thumb, it's wise to plan for 1-2% of the property's value in annual running costs. This figure can vary depending on the location, size, and amenities of your villa, but it provides a reliable estimate for your financial planning.

Can I Get a Mortgage in Spain as a Foreigner?

Absolutely. Spanish banks are very familiar with lending to international buyers, though the terms differ slightly from those offered to residents. Typically, non-residents can borrow 60-70% of the purchase price or the official valuation—whichever is lower.

This means you will need to provide a cash deposit of 30-40%, plus an additional 10-15% to cover all the associated taxes and fees. When assessing your application, banks will want to see proof of income, a clean credit history, and employment details from your home country. Using a specialised mortgage broker can often help you secure the most favourable rates and terms available.

Navigating these final questions is often the last step before your dream becomes a reality. At AP Properties Spain, we're here to provide clarity and support through every stage of your journey.

Contact us today to discuss your plans to buy a villa in Spain